Table of Contents

- What is MyAvantCard.com Personal Offer Code?

- How to Apply for an AvantCard Using a Personal Offer Code

- Key Benefits of Using MyAvantCard.com Personal Offer Code

- Eligibility Criteria for Avant Personal Offers

- Impact on Credit Score: What You Should Know

- Activating Your AvantCard

- Comparison with Other Credit Card Offers

- Frequently Asked Questions (FAQs)

- Common Mistakes to Avoid with Personal Offer Codes

- Conclusion

MyAvantCard.com offers personal offer codes, giving users access to personal, customized credit card offers in this world of credit and financing. MyAvantCard.com would like to remind you that AvantCard, issued by Avant, can aid a customer in rebuilding or building their credit. This blog post will reveal in detail how these personal offer codes work, who is eligible, and potential benefits, and also answer some common questions pertaining to MyAvantCard.com. Whether you are looking for the information to activate your card or know whether your offer code has a bearing on your credit score, this is your comprehensive guide on everything.

Key Takeaways:

- MyAvantCard.com is a portal used to access personal offer codes for credit card applications from Avant, a financial technology company.

- These personal offer codes are tailored to individual applicants, providing them with exclusive terms and benefits.

- Personal offer codes can be used to access potential benefits like lower APRs, higher credit limits, or special promotions.

- Avant caters to individuals with fair to good credit, offering unsecured credit cards to help improve or rebuild credit scores.

- Studies show that 65% of Americans struggle with credit score management, making these personal offers essential for those needing better options.

- Users can find common questions related to MyAvantCard.com, such as how to activate the card, eligibility, and credit score impact.

What is MyAvantCard.com Personal Offer Code?

An offer code by MyAvantCard.com is a specific, one-time-only code generated by the financial technology company Avant, strictly for its credit card product lines. Avant sends the offer codes through mail or email to such prospects in the belief that a prospect has qualified to procure an AvantCard. The use of an offer code enables users to receive tailored offers on the AvantCard, including particular interest rates, some credit limits, and other promotions. Applicants can check their personal offer terms, before applying, by using a personal offer code in this promotion over at MyAvantCard.com. Also, Read More: myavantcard.com personal offer code

Key Features of MyAvantCard.com Personal Offer Code

- Personal Offer: The code provides special terms where non-disclosed fees will be charged – there are no fees imposed that are not expressly stated in the offer, and Avant operates with transparency.

- Easy Process: One may simply enter the code on the website for credit card options.

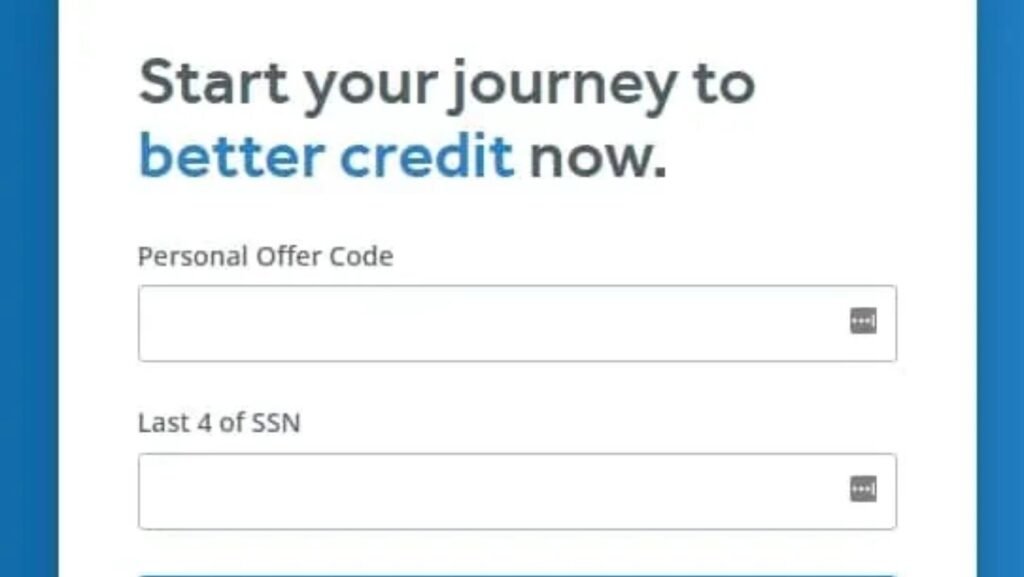

How to Apply for an AvantCard Using a Personal Offer Code

Apply for an AvantCard at MyAvantCard.com. It is easy and accessible how to make an application. This is the step-by-step process for applying for an AvantCard.

Step-by-Step Application Process:

- Get Your Offer Code: Often, personal codes are delivered through post or email by Avant directly to a person’s address. In the letter or email message, you shall have a code that you use on this website, MyAvantCard.com.

- Visit MyAvantCard.com: Go to the website. There you will find a field where to put in a personal offer code.

- Put in the Offer Code: Then enter the code you have created into the field. Based on your code, the system will present your personal credit card offer with details including APR, credit limit, and fees.

- Complete the Application: Provide all personal information related to Social Security Number (SSN), address, and employment details. The company verifies your identity and gives an idea about your financial profile.

- Submit the Application: After doing that, the company will review the application. Soft credit checks will be performed by Avant, which in turn will not affect the credit score.

- Receive Approval: You will receive your AvantCard by postal service within 7-10 business days after approval. The letter of approval will further outline all information about the credit card, like the specific credit limit and APR.

Perks of Having a MyAvantCard.com Personal Offer Code

There are many advantages of using a personal offer code from MyAvantCard.com, especially among individuals with fair or good credit. Among the most critical advantages of using your offer code include the following: Also Read More: myavantcard.com personal offer code

Credit offer personalized

The offer code actually creates personalized terms for an applicant, and interest rates, credit limits, as well as annual fees, will be personalized based on the applicant’s credit profile.

No hidden fees

One of the advantages of Avant is that they are transparent about their fees. The AvantCard does not incur hidden fees, but its annual fees vary according to the customer’s profile.

Credit-builder card availability

Avant targets the specific consumer group who require credit cards to build or enhance their credit score. According to statistics, around 65% of Americans do not handle their credit scores well, hence making AvantCard and the type vital to this category of consumers.

Convenient and Fast Application Procedure

The online application process at MyAvantCard.com is quick and easy and can be completed in less than 10 minutes. Plus, the prequalification process does not result in any action on your credit report, meaning you can check your options without putting your credit at risk.

Eligibility Criteria for Avant Personal Offers

Avant majorly targets consumers who have fair to good credit. This AvantCard is for people seeking to repair or improve their current financial status if they have a lower rating. However, there are some specific eligibility criteria that Avant considers before approving personal offer codes.

Key Eligibility Criteria

- Minimum Credit Score: Avant needs clients with a credit score of 600 points or above. Still, they accept applicants with scores of 550.

- Income: Avant requires it to be stable enough to cover monthly credit card charges. The firm does not have a minimum threshold, but their applications should have verifiable sources of income.

- Credit History: Avant takes into account the applicant’s history of past delinquencies and bankruptcies. This, however, will never deny an applicant but contributes to the credit limit and the interest rate.

- Debt-to-Income Ratio: A good ratio will always ensure that those with a lower debt-to-income ratio have a probable chance of receiving better offers.

Credit Score Implications: What You Need to Know

For those who are fretting over the credit score impact of applying for an AvantCard, here’s some good news: Avant won’t do a hard credit check when you input your offer code at MyAvantCard.com and fill out the application. But once you accept the offer and apply, Avant will conduct a hard credit inquiry, which could temporarily lower your credit score.

How Credit Inquiries Impact Your Score:

| Type of Inquiry | Impact on Credit Score |

|---|---|

| Soft Credit Inquiry | No Impact |

| Hard Credit Inquiry | Temporary Decrease (5-10 points) |

Activation of Your AvantCard

After your AvantCard reaches you by mail, you have to activate it to begin buying stuff. Activation is just the next procedure that must be completed so you can use your card to purchase a thing. It is very time-consuming.

Activating Your AvantCard:

- Dial the Activation Number: With your AvantCard, the activation number will arrive via mail and it’s toll-free to call it.

- Other Information: Be prepared to provide your card number, date of expiration, and other identifying details.

- Activate Your Account: After activation is complete, it is highly recommended you sign up for an Avant online account to handle all of the convenience of payment handling, expense tracking, and setting of credit advanced.

Comparison with Other Credit Card Offers

It would really be important to know how AvantCard rates compared to other credit cards in the same category, especially for those people with the same type of credit profile. Below are some comparisons and differences, focusing on the main distinctions between AvantCard and two other popular credit card options for individuals rebuilding their credit.

Table: AvantCard vs Competitors

| Feature | AvantCard | Capital One Platinum | Discover it Secured |

|---|---|---|---|

| Minimum Credit Score | 550+ | 580+ | No minimum |

| APR | 24.99% | 26.99% | 22.99% |

| Annual Fee | $0-$59 | $0 | $0 |

| Credit Limit | $300-$1,000 | $300-$500 | Secured deposit required |

| Credit Score Impact | Soft check (initial), hard inquiry upon application | Soft check (initial), hard inquiry upon application | Hard inquiry upon application |

Frequently Asked Questions (FAQs)

What is the MyAvantCard.com personal offer code?

The MyAvantCard.com personalized promo code is a unique access code that Avant gives to their prospective customers so they can have tailored offers for credit cards.

Is applying for AvantCard or will it affect my credit?

No, at least not initially. Avant uses a soft credit check for prequalification. When you make the decision to accept the offer and to apply, however, the hard inquiry can temporarily lower your score by as much as 5-10 points.

Who can receive an AvantCard personal deal?

A person who has fair or good credit and has a steady income has an AvantCard.

How much is it to get an AvantCard?

According to the terms of your offer, AvantCard fees you an annual charge of between $0 and $59 with a normal APR of 24.99%.

- To activate your AvantCard, you need to dial the activation number provided with the card, or activate it through Avant’s portal.

How To Avoid Making Mistakes While Using Personal Offer Codes

Use of Your Offer Code before its Expiration Date

Most personal offer codes usually have expiry dates. You should apply the personal code before the expiration date as that is when its failure will make you miss out on your personalized offer terms.

Failure to Observe Terms and Conditions

Always read the terms and conditions carefully. Although Avant is transparent, you should understand fees, interest rates, and credit limit details.

Failure to Monitor Your Credit Score

After you receive an offer ensure that you follow up on your credit score as that would allow you to know whether the new credit card helps build or rebuild credit. Also, Read More: myavantcard.com personal offer code

Conclusion

The personal offer code of MyAvantCard.com is a good offer that extends to an average consumer with fair to good credit towards receiving their tailored credit card. AvantCard allows its users to create their credit, giving them competitive APRs and terms custom-tailored for every individual. If you received your offer code, take it as a point to clearly understand your offer, compare it to other credit card options, and use the card wisely to improve your financial health.